…to be continued

Dr. Stefan E. and his infrastrucure are incompetent to produce an asset list in almost four years. However they collect €90.000,- as service fee and €850.000,- in inheritance tax.

Germany as a country ist a joke.

The USA issues a penalty of 25% for not presenting an asset list in three years, they are right!

Reference: 192-74-1419

Dear Ms. Davies,

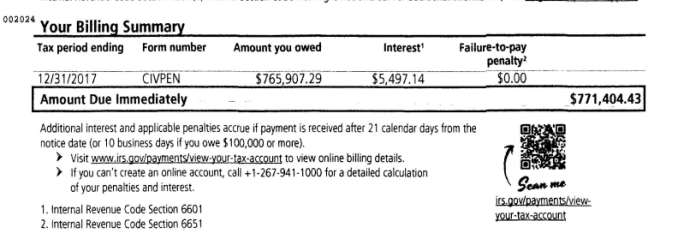

I received a letter from the IRS on the 3rd of May 2021 telling me to pay $771,404.43

I cannot pay this amount, since the executor of the will, Dr. Stefan E. in Dessau, did not yet transfer those assets to me. I understand from my tax accountant in New York, that the amount is due based on a penalty of 25% for failing to send form 3520.

He wrote:

“It’s is a penalty of 25% of the value of the inheritance for the late filing of Form 3520”

Until today I do not have, nor was it submitted to the German court, an asset list that would be the basis for filing US form 3520 properly. Therefore I request that this fine be delayed until I have received those documents from the executor of the will, Dr. Stefan E., and German authorities.

The German state earned 30% of the inheritance and Stefan E. €90.000,- without presenting a proper asset list. This process now lasted almost 4 years. I feel therefore Germany is a dysfunctional or corrupt country. Sorry, there is nothing in my control that I can do. I hired a lawyer and even the court and the prosecutors are dysfunctional to a degree that is absolutely unacceptable!

Best regards,

Eva Lewinter

+49 15222302069

evalewinter@gmail.com

2223.SR

Dr. Wilhelm Wolf – why are you connected?

“Lady Gaga” – how are you?

That’s just what Computer Detectives was waiting for.

Write to computerdetectives2020@gmail.com.

We observe errors in Think Tank Technologies.

©Computer Detectives 2021