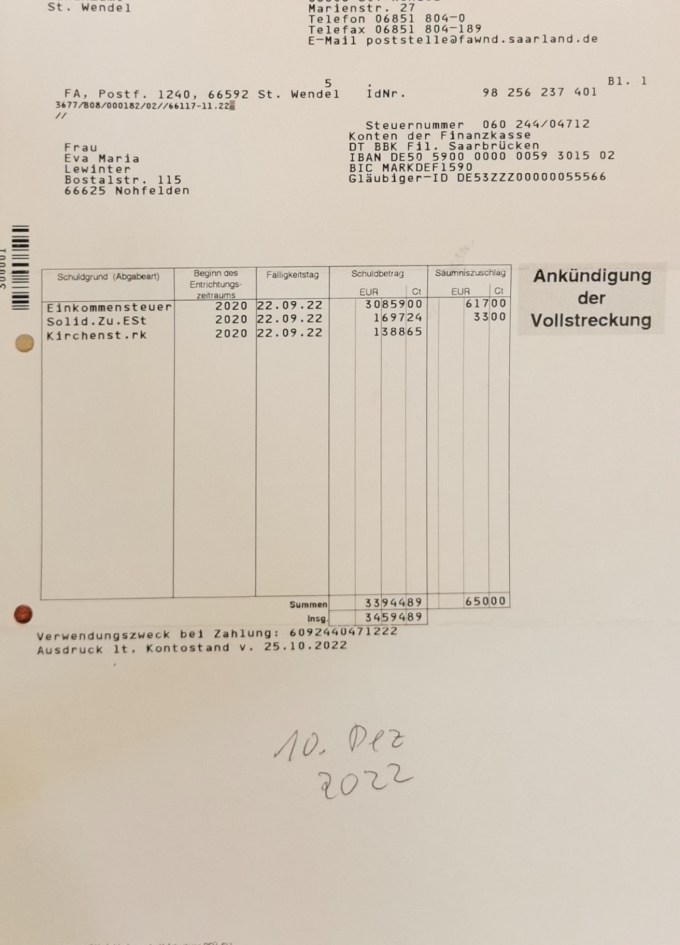

..the German tax department requests €30.000,- in income tax payments evenso the German tax accountant only calculated €7.000,- how can this be? And how can this be when the cash flow shows a negative €30.000,-? This kind of calculation cannot be covered, even when living on welfare level.

Now there is the executor of a will, Exner, who embezzels €200.000,- and he is not releasing any money and he is on the title of all inherited properties , therefore they cannot be sold . And the judge says he is not doing anything wrong.

How can one part of German administration ask for €30.000,- while the other part of German administration fails to release funds from an inheritance to cover those financial responsibilities?

Who is the puppet master of this dirty game, that has absolutely nothing to do with proper legal procedures in Germany?

I have an idea…

—

Disclaimer.