Dr. Stefan Exner in Dessau received €90.000,- to process the Meyer-Stoll inheritance according to legal requirements.

Ines Zemelman’s tax accountant company, TFX – taxes for expats, was and still is in charge to file the tax return including the Meyer-Stoll inheritance correctly, they too have been paid their professional fee.

A judge in Germany at the court in Königstein Taunus ruled, that Dr. Stefan Exner didn’t do anything wrong as executor of the Meyer-Stoll inheritance.

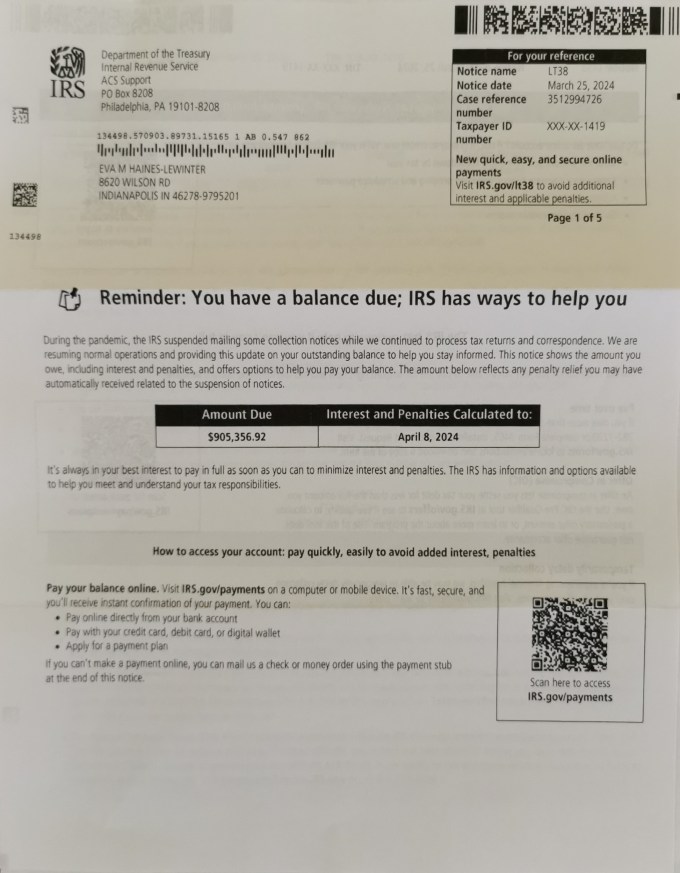

The letter from the IRS is computer generated. Who is the responsible clerk that sends out such letters? The reply to the first such letter was ignored.

In fact the necessary forms were filed correctly and there is absolutely no tax due. In fact this is not inheritance tax, since inheritance tax was paid already in Germany. This fraudulent demand is a 25% fee on a inheritance filing past the due date. Now here is the contradiction: if they say the form about the inheritance was not filed, how do they know to calculate the 25%. This is for sure a violation of the double taxation law.

The letter from the IRS doesn’t show a responsible clerk.

The behavior of the so called IRS is more than suspicious.

This is way beyond the “Computer Detectives Intercouse-Stupid Certificate”.

It looks to me somebody is fighting back because of the wrongdoings documented here. It looks to me that this is a cooked up case of foul play to distract from analysis about abuses in virtual weapons connectivities. Keep trying, I am not playing your dirty game.

The fact is, that Germany generated the final inheritance tax numbers in the year 2021 and the US is asking for them in Oktober 2018. If this isn’t fucking-stupid, then I don’t know what is.

taxes for expats, (1).

TFX, (2).

FTX, (3).

Sam Bankman-Fried, (4).

FTX Trading Ltd., commonly known as FTX (short for “Futures Exchange”), (5).

FTXP is a transaction code in SAP, (6).

Frequency, (2000).

When you send a message fast enough through an array of satellites in the opposite direction than earth rotation you can transmit results from the present in the past. Or results from the future to the present.

That would also be a method to illegally control the stock markets.

Bleak House

1852–1853 novel by Charles Dickens.

The killers of Princess Diana are playing this?

bleak like Rosemarie Meyer-Stoll. Dr. Stefan Exner keeps her name alive on my Crédit Suisse/USB stock portfolio.

USB the bank where I invented the algorithm for profit optimized bank refinancing. Morgan Stanley said the algorithm would make Wallstreet go away.

– Your letter from March 25th 2024, see attached and returned.

Dear Sir or Madam,

I received a similar such letter on February 27th 2024 to which I replied by certified mail February 28th.

I consider your letter as a case of fraud, malpractice and foul play. The reasons as follows:

The inheritance, that is subject to your fine was completely in Germany, all taxes in regards to this inheritance were paid in Germany, this means in particular, that 30% inheritance tax was paid in Germany according to German law. This fact was documented and filed with US authorities through the tax accounting firm, Taxes for Expats owned by Ines Zemelman in New York, they have been doing my taxes since 2015. Your due date of October 2018 to file the related forms for this inheritance from Germany in the US could not be fulfilled because the United States has no jurisdiction for any such due date towards tax authorities in Germany. In fact, the value of the inheritance in Germany was only established until the year 2021. This is also documented in the US.

Dr. Stefan Exner in Dessau Germany as well as Taxes for Expats in New York, both professional fees have been paid, failed to support me in filing extensions in the US.

The fee in this letter violates the double taxation agreement between the United States and Germany and therefore has to be considered as fraudulent.

Also, the fact that this letter is computer generated without a responsible clerk is indication of a fraud or foul play scheme.

My letter from February 28th was not answered.

The IRS letter dated February 26th 2024 was sent from Cincinnati OH, this letter is sent from Philadelphia. I request the name of the responsible clerk and supervisor for this action.

Until the IRS in the United States revokes this fraudulent double taxation between the United States and Germany, I will consider any further letters as fraud and document this case as intentional wrongdoing.

Please reply to this certified letter until end of May 2024 with the following information:

a) The name and employee number of the responsible clerk and his or her supervisor.

b) Should this be a computer glitch, I offer my professionals services as a master in computer science at a rate of $300/hr.

Unless you reply in a qualified way, I will consider any further such letter as fraud.

The reply of taxes for expats :

Thanks, Eva.

My suggestion is the same as we’ve discussed. Retention of a lawyer.

Question did or didn’t Ines Zemelman ‘s company their do their work correctly? They confirmed everything was done correctly.

the fraudulent demand and the unprofessional conduct was reported to law enforcement in the United States of America.

January 2025 a letter from my US lawyer :

quote : Upon careful examination, it is evident that a critical factor—the absence of a tax treaty between the United States and Germany—was not considered in the original reporting. Our expertise in international taxation, estate issues, and IRS dispute resolution allows us to effectively identify and address these oversights. Based on our experience, we are confident that we can substantially reduce your total liability.

We believe the case presents a substantial opportunity to challenge the current assessment and resolve this matter favorably. Our strategy will leverage our deep understanding of IRS regulations, international tax principles, and any additional mitigating circumstances relevant to your situation. end quote.

This is unbelievable!

Now I have to sue the US government because they don’t have their shit together? What happened to the old existing double taxation law? Did it get lost in the international artificial intelligence pissing contest?

This deserves today’s “Computer Detectives Intercouse-Stupid Certificate “.

This lawyer did an excellent job to show, that the IRS doesn’t know how to do their job!

Disclaimer.