the universe strikes back.

For several years now, taxes for expats is doing my tax returns.

In 2018 the form 3520 was filed by their employee Jackie. This means that I do not need to pay taxes in the US, when I have paid taxes in Germany for real estate that I inherited in Germany, I just need to report the fact.

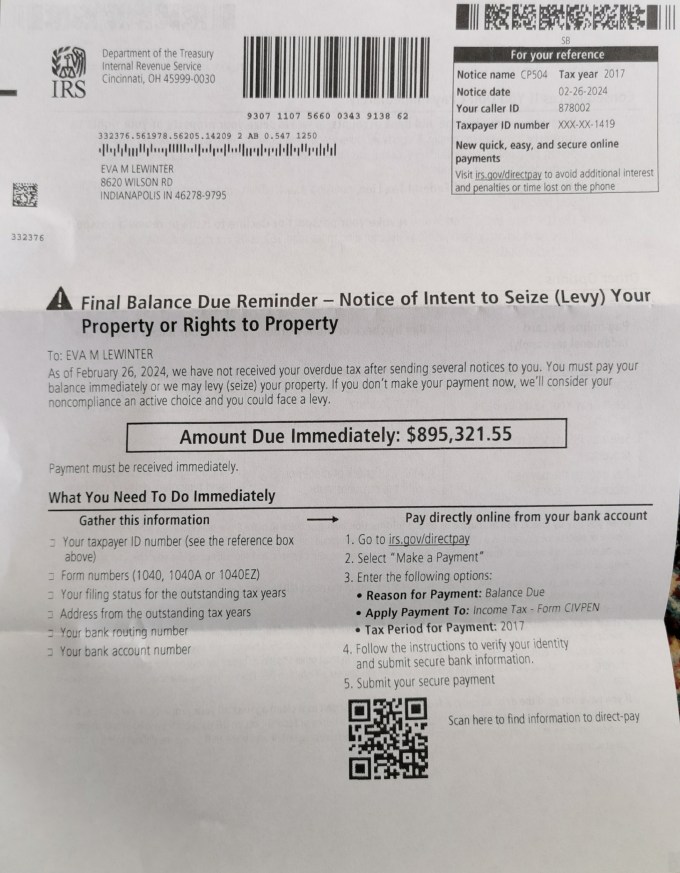

2017 is now 8 years ago and it happens now the second time that individuals at the IRS assume I didn’t file the 3520 with 3520-A form and it comes with a hefty penalty.

Why is that?

Is it a simple clerical error?

Is somebody trying to make my life miserable because of what?

the corruption bonding attacks the incorruptible?

Or is it pure blinding jealousy?

It doesn’t look good for Ines Zemelman and her company and the individuals at the IRS that don’t do their job right.

When you follow my troubles with the wrongdoings of Exner and this new intermezzo, then this looks very coordinated to me. What is the problem here? That bullshiters feel trapped and fight back? Who are they?

—–

explanation from TFX:

The due date for Form 3520, on which the penalty was assessed, is Oct 15 9 (with extension) of the year following the year the form reports.

For 2017, the form was due Oct 15, 2018 (with extension).

We were engaged Dec 13, 2018 for the Form 3520.

The penalty assesses 25% of the value of the inheritance as a fine for being late.

Two tactics for abatement:

You confused Form 3520 with the Form 3520-A due dates, or

You can try refencing the Farhy case, which prohibits IRS from assessing some penalties on certain informational forms.

—–

the mistake that is made here is the assumption that the fact of a due date can be enforced : when I have a due date, I cannot force the responsible parties to reply to me to fulfill the due date I have. The due dates are enforced with penalties, fines and filing costs for extensions, however you don’t have those instruments available so you can fulfill your obligations. Abuse of power. It doesn’t change the fact that you are crushed between two systems (US tax system and German administration) because each side tries to play your time-all activity function for their own advantage. They belief whenever they claim your function they win. This is not the case.

As a consultant, we called it “violation of the obligation to cooperate” in German “Verletzung der Mitwirkungspflicht”.

—

I trust Taxes for Expats to manage my tax filing responsibilities.

I was under the assumption that 2017 was done correctly.

The fact that a simple due date issue and the failiure to accept an explanation of my situation leads to a charges like this cannot other be than foul play from my point of view (foul play happend before when I was threatened to pay 50k Workman’s Cop for NY when the company had only 20k in sales, the threat and demand was based on an estimate) . I will get to the bottom of this.

— Wednesday, February 28, 2024

Department of Treasury

Internal Revenue Service

Cincinnati, OH 45999-0030

Dear Sir or Madam,

I received your letter from 2-26-2024.

I object to the charges: The process that comes up with those charges is fraudulent. Since the year 2015, I file my tax return with Taxes for Expats in New York, the business of Ines Zemelman. My tax accountant Jackie filed my return in 2017. I was not aware of any wrongdoing, in contrary, I keep all of my processes very transparent, in fact I document them in a daily blog on the Internet.

In the year 2017, I inherited and the forms were filed according to the legal requirements in Germany and the United States. However, several of my rights in this process were ignored and I could not keep due dates, because the required information was not provided to me in a timely manner. I spend Euro20.000, – for a lawyer, Ms. Kuehn on Germany, however she was not successful and I owe her. Because of the inheritance I am delinquent in my health insurance payments in Germany that went up from Euro200 to Euro900 monthly with Techniker Krankenkasse in Germany and backdated for 2 years. I currently do not have health insurance, luckily this year in May, Medicare will kick in.

I currently live from $850. – social security and cannot afford a car anymore.

The income from my real estate in Germany is used by a manager to pay my taxes in Germany and the repair and maintenance of my real estate.

As reported many times, the executor of my inheritance, Dr. Stefan Exner, fails to respond in a timely manner and violates the German law by not providing any financial reports.

In January 2018, German authorities pulled my German passport, I am a dual citizen since 2013, the reason they gave was that I supposedly used a false name, Eva Lewinter, they claimed my name was Eva P. (my maiden name), the fact that my name was changed by marriage in 2006 and by obtaining the US citizenship in 2013 was not taken in consideration.

At the time, because of endless delays with German authorities, I did not have the cash flow to pay for endless extensions for my tax filing in the US. I had to renovate the inherited real-estate to be able to rent them out, when I couldn’t pay my bills I became delinquent on my insurances. The executor, Dr. Stefan Exner, failed to provide payouts from Credit Suisse, now USB. I left Germany in July 2022 because of my eroding financial situation there.

The fact that my correct filings are not accepted because of a simple due date issue, looks like “foul play” to me. This happened before when a payroll company based in New York City requested 50K Workman’s Cop when my business had only 20k in sales (at the time similar threats were made like the one in your letter). At the time the payroll company explained the fee was based on an estimate, which didn’t stop them from making threats to seize against my property.

Your claims from the letter of February 26 2024 look like foul play to me and therefore I cannot take this seriously. This is not a proper national and international process at all.

Please review my case and correct your process!

Best regards,

—-

to the assholes who decided that Exner isn’t doing anything wrong :

Exner took out 1 Million Euro from a stock portfolio that I inherited to pay about 850k in inheritance tax in Germany. There is no financial statement available about this transaction to me in spite of the fact that I requested this report several times since 2017. My legal rights to obtain this financial statement are ignored for 7 years (!) now, a judge in Germany decided Exner is not doing anything wrong. So I am waiting for 7 years for financial reporting from Exner to which I am legally entitled to (BGB) and supposedly nothing was done wrong here, whereas I am getting fined with 800k by the US for missing a due date (running out of money for extension fees) by two month. I call this being fucked over by criminals!

This deserves today’s “Computer Detectives Fucking-Stupid Award”.

excuse my language, the style is angry young woman for screen writing ideas. This came up when Marlon Brando playing angry young man as Stanley Kowalski in A Streetcar Called Desire, (1951).

—-

… you should take the IRS matter seriously…

—-

Jackie prepared the reasonable cause letter, which is the first line of defense. If that doesn’t work, we can send another one or you can reference the Farhy case.

—-

Sehr geehrter Dr. Stefan Exner,

ihr Fehlverhalten meine Angelegenheit im Rahmen der gesetzlichen und internationlen Anforderungen zu bearbeiten, hat nun zu Fehlverhalten der Steuerbehörden in den USA geführt.

Das Resultat sehen Sie im Anhang.

Mit freundlichen Gruessen

—

Real estate speculator are calling.

Jack Reacher (2012).

—

I know you’re waiting on me for a reasonable cause letter. I’m going to see what I can do for you this week. I still think an attorney would be your best option, following the instructions in the letter.

I will not spend any more money to remedy a situation that was caused by people I paid to do a professional job. If the IRS keeps insisting on the fine, I will document the wrongdoings and move on. I am not fighting about money, when I know I am right.

—-

Exner was asked for a cash payout to file for extension. He didn’t do it even after being explained the obligation with Wesley Snipes as an example.

The IRS does ask for a fee to file for an extension, what tax accounting company that prides itself for filing internationally, isn’t filing an extension on behalf of their customer by putting the fee on the customer’s account of a hundred or two hundred dollars to avoiding a fine of $800,000.-? What game is this?

For the foul players : what do you expect me to do by playing this dirty game with my taxes and why do you feel I am responsible? Do you really mean you can better your situation by making my life miserable?

—

Disclaimer.

How did this get resolved? We received something similar. Our attorney is working on it.

LikeLike

I have an attorney too. My case is the result of the IRS violating double taxation agreement between Germany and the United States. I return all IRS invoices in regards to this matter to the IRS as fraudulent. I got law enforcement involved. The United States doesn’t have jurisdiction in regards to the tax process in Germany, meaning, the United States cannot dictate due dates to German administration. The executor Dr. Stefan Exner failed to comply to my responsibilities towards the United States, however German authorities judged he did nothing wrong. Germany also isn’t enforcing their own laws and ask me, the tax payer to do that. There is clearly at lot going wrong in global processes. I will continue to document this here.

LikeLike

Was your case international?

LikeLike